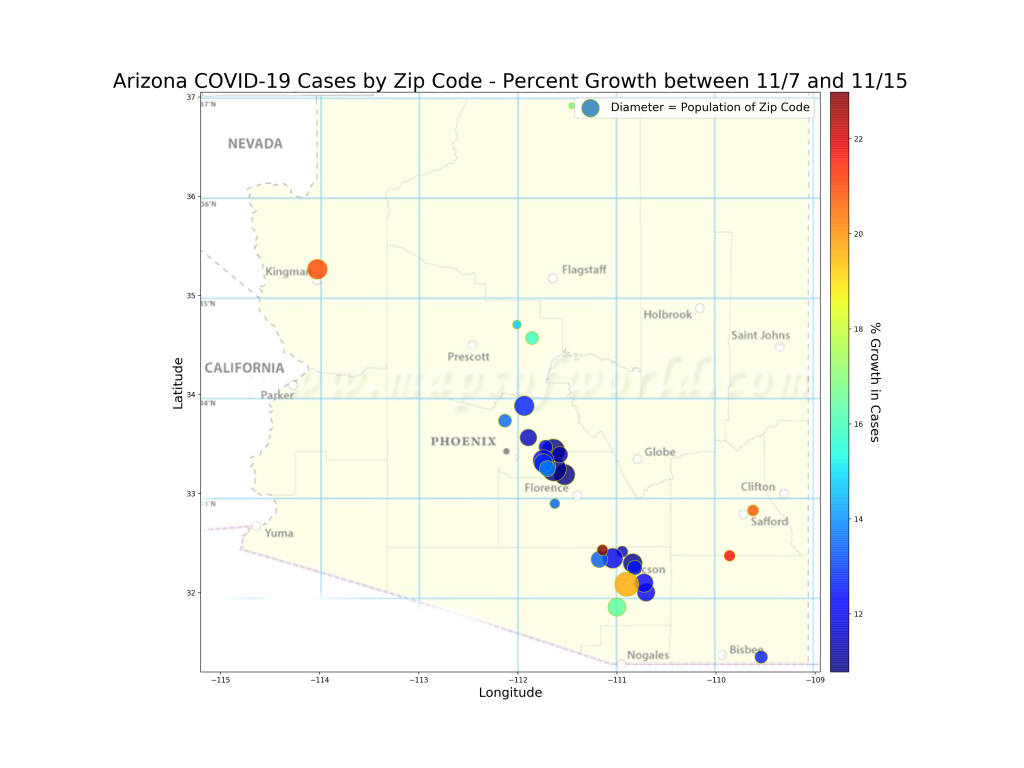

I decided to evaluate the new cases from the current outbreak differently. Previously I was interested in where case growth as a percentage of previous cases. This may be a useful metric, because it signifies anomalous case growth in a specific location. Presumably that info could be used by a public health organization to target localized outbreaks.

However, perhaps much more interesting would be Zip Codes where high case growth per 1000 residents is happening. The chart below shows this metric. Both the cumulative number of cases (blue) and the last month’s case growth (orange) are normalized by the population of the Zip Code.

What does this chart tell us?

- On the left of the chart, we see the zip codes (see table below for better visibility into this portion of the chart) that have had the largest number of cases per 1000 residents cumulatively (since the beginning of COVID). A couple of these regions have seen very high growth in the last month. But as your eyes move rightward, you can see some regions that had experienced high COVID cases in the past that had lower numbers of outbreaks in the last month. And of course, other areas (the peaky orange lines) have experienced very high numbers of cases in the last month. It would be good to understand why some regions have had worse outcomes over the last month than other regions. We’ll evaluate some of this below looking at the table.

- The general trend does seem consistent, though. Regions that experienced higher numbers of cases during the summer outbreak are in general experiencing higher numbers of cases during the current outbreak. I was hoping to see a different trend (that might have indicated immunity in some regions) but will keep watching for that trend to emerge.

Details of the Normalized Case Growth

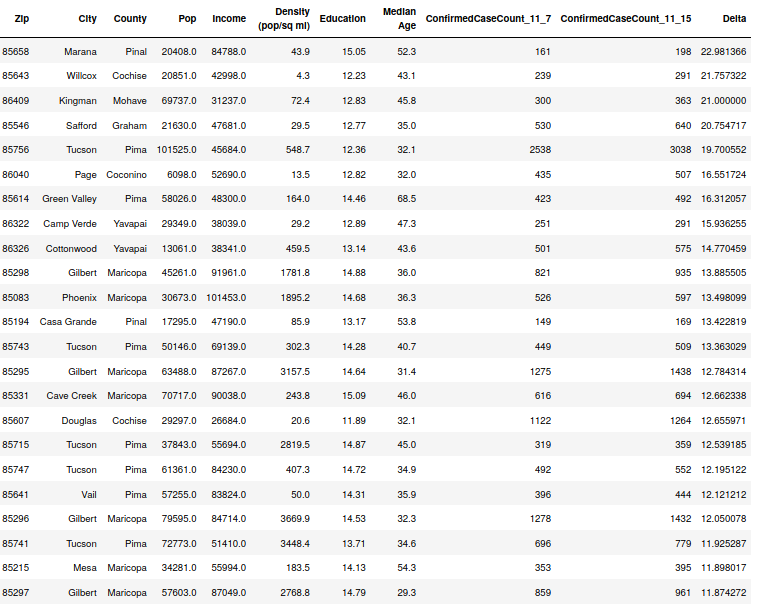

The below table is sorted by the Cumulative Cases per 1000 in a Zip Code. The Growth-Norm column represents growth in Cases per 1000 over the last month. Note that some regions that have experienced high case growth up to this point didn’t have nearly as large of Case Growth as other regions that had experienced similarly high cases in the past. These are circled in green. You can also see regions with larger than expected case growth circled in red. Are there any factors that might be correlated with this lower and higher amounts of growth?

The first thing that I rule out is Education and Median Age. These on the surface don’t seem to be related. Some regions with lower median age are right next to regions with 15 or so years higher in median age. The same applies for education. What I do see, however, is a trend with population density, where regions with higher population density seem to be seeing lower COVID case growth per 1000 people. This might make some sense if you think about how regions with high density generally always have high populations, and therefore, a larger denominator in the growth per 1000 person equation… However, this also means that the numerator (the change in case count over the last month) is disproportionately low. Which, I think is interesting. Why would there be less cases than expected in regions with higher density? Thoughts:

- I wonder if this might be an indicator of the effectiveness of government interventions (mandatory masks, school restrictions, etc.)? Since all the data I’ve seen indicate that school restrictions aren’t resulting in large numbers of case reductions (regardless of whether they’re in school or not, every study seems to be showing that people under 15 don’t really transmit the virus), and most regions don’t have restaurant/gym/bar closures now, I’m assuming if it is anything it is the mandating (and compliance!) with the mask restrictions. Unless someone can chime in with a different idea…. Compliance is an interesting thought, because it seems like in a more populous area, there appears to be more social pressure to comply with COVID restrictions. Whereas, my observation is that in less dense areas, the social pressure is much less.

- Also interesting to me is the resurgence of cases on the border. These regions were very quiet ever since the summer wave slowed down and generally went from having the highest case rates in the country down to the very lowest. But now we see Yuma and Santa Cruz counties experiencing case growth again. Also, the South Mountain region of Phoenix (85042) is also experiencing another surge in cases. But looking at the highest number of new cases per 1000 over the last month, we see some interesting places. Page (up near Lake Powell), Cottonwood (near Prescott), and Douglass (on the border, but only lightly affected during the summer border rash of cases) all are near the top of the list with 85350 in Yuma.